A Global Minimum Tax Rate: Is this Corporate or Personal?

Many large corporations make most of their income overseas, thus paying taxes at varying rates. Some of these companies include Nvidia Corp, Broadcom Inc, and Las Vegas Sands Corp. Treasury Secretary Janet Yellen is proposing a solution to bring jobs and greater revenue collection back to the United States. In a speech to the Chicago Council on Global Affairs on April 5, 2021, Yellen touted that “we can use a global minimum tax to make sure the global economy thrives based on a more level playing field in the taxation of multinational corporations, and spurs innovation, growth, and prosperity.” She explained, “We are working with G20 nations to agree to a global minimum corporate tax rate so that we can stop the race to the bottom” (1). The initial rate would be 15%, but the Department [of the Treasury] released a statement in late May, stating that they “underscored that 15% is a floor and that discussions should continue to be ambitious and push that rate higher” (2).

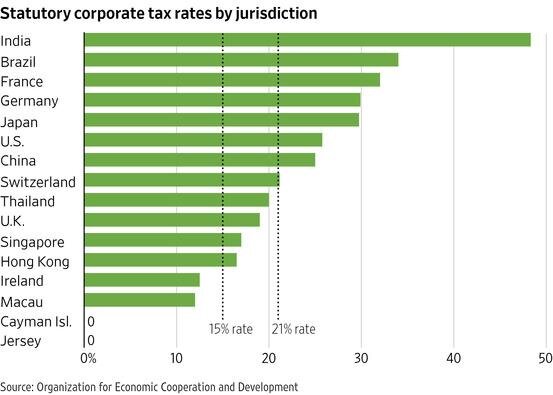

The key focus in implementing such a tax would be to discourage companies, whose primary business is earned domestically, from relocating operations to other countries, thus reducing their tax liability. If the U.S. raises its tax rates and imposes a higher tax burden on U.S. companies' foreign profits, a global minimum tax would help prevent companies based in other countries from having a significant potential advantage. This coordination and the ensuing tax revenue—not necessarily the aims to U.S.-based companies—rank high on the administration's priorities. (3) For example, many of America’s largest companies establish domiciles in Ireland, where corporate tax rates are 12.5%.

9 out of the largest 11 companies in Ireland are headquartered outside of the country. 8 are American-based companies. The only two Irish companies are CRH and Trane Technologies (4). Ireland is just one example of international tax havens that many companies look to reduce their tax burden. Macau, Cayman Islands, Jersey, and the British Virgin Islands are also notable havens that would be negatively affected. On the other hand, many European nations, such as France and Germany would benefit from the global minimum corporate tax, as their current tax rates sit above the 15% threshold.

Before the Tax Cuts and Jobs Act of 2017, foreign profits of U.S. multinational enterprises (MNEs) were subject to U.S. taxes, but only when repatriated (brought back to the US). This system incentivized firms to keep profits abroad, and, by the end of 2017, U.S. MNEs had accumulated approximately $1 trillion in cash abroad, held mostly in U.S. fixed-income securities (5).

The TCJA shifted policy to tax profits based in the territory in which they are earned. Therefore, any income earned in Ireland, for example, and repatriated would not be subject to US corporate taxes. However, companies with accumulated earnings prior to 2017 would be subject to a one time, significantly lower, tax on any earnings they bring back to the country (payable over 8 years).

Balance of payments data show that U.S. firms repatriated $777 billion in 2018, roughly 78 percent of the estimated stock as of end-2017 of offshore cash holdings. Repatriation was strongest in the first half of 2018, when $510 billion was brought back, and continued throughout 2018, albeit at a slower pace (figure 1). Despite this slowing down, repatriation flows could remain above their pre-TCJA levels because the TCJA eliminated the tax incentives for keeping profits abroad. For reference, the Homeland Investment Act of 2004 (HIA, also known as the "tax holiday"), which provided a temporary one-year reduction in the repatriation tax rate, resulted in $312 billion repatriated in 2005, of an estimated $750 billion held abroad (6).

Nonetheless, France and Germany have already agreed to Yellen’s proposed global minimum corporate tax plan. While it is still unclear whether a global minimum tax will ever come to pass, the worm seems to have turned on corporate tax levels. Companies that pay very low corporate taxes -- and their investors -- should brace for impact (7).

1) US Department of the Treasury, April 5, 2021

2) US Department of the Treasury, May 20, 2021

3) The Wall Street Journal, April 5, 2021

4) The Irish Times, June 11, 2021

5, 6) Board of Governors of the Federal Reserve System, August 9, 2021

7) The Wall Street Journal, May 25, 2021